Support our work

Support the Institute for the Study of Welsh Estates

ISWE is emerging as a fresh cultural intellectual presence in the life of Wales: A new national centre dedicated to promoting innovative research and projects about our histories, cultures and landscapes.

Your philanthropic support makes a real difference to what we can achieve.

If you share our aims and aspirations and are able to contribute towards our mission, your support can help to:

- Nurture the next generation of researchers, ensuring that the study of Wales and its heritage and culture remains a vibrant academic focus

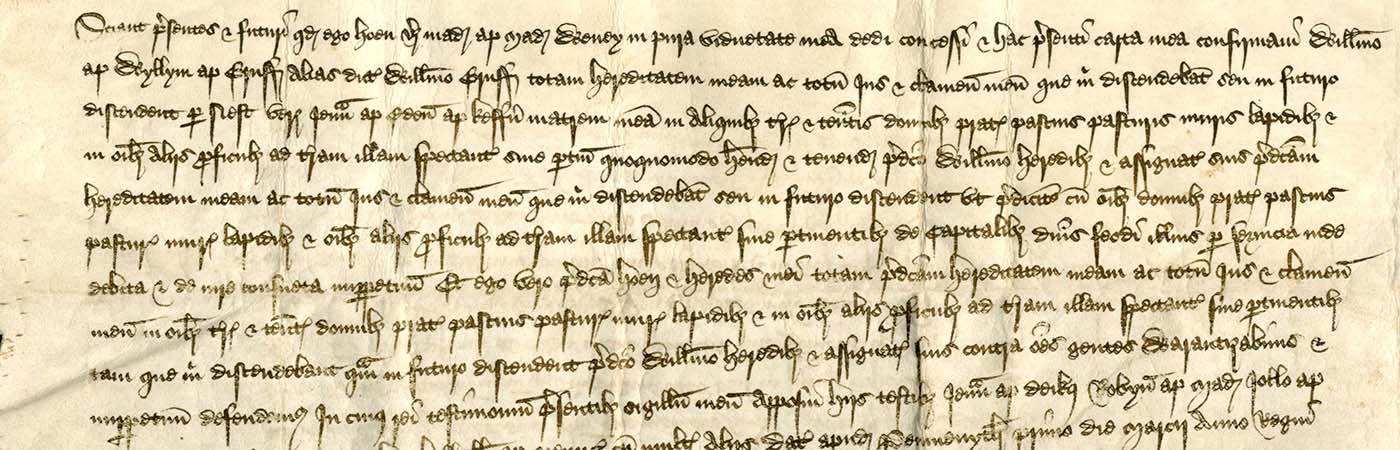

- Unlock the incredible narratives and information found within archives and about country houses, estates and communities across Wales

- conserve, record, digitise and exhibit important parts of the nation’s documentary heritage, held within the University’s Archives and Special Collections

- promote the history and heritage of Wales to new and wider audiences, through public events, outreach activities and publications

Friends of ISWE

The most direct way to support our work is to become a Friend of ISWE. The Friends was established in response to the significant public interest in our work and their support, engagement and encouragement is crucial to our growth.

We are delighted to invite you to become a Friend and to consider a single or annual gift of £25, £50 or £100.

Gifts can be made online at https://www.bangor.ac.uk/giving/how-to-give.php.en

Donations are also welcome by cheque, credit card and Direct Debit. Please see the contact details below.

Many thanks for your support!

Other Gifts

We also welcome larger one-off, regular or legacy gifts, including funding to support particular projects, doctoral studentships and bursaries. Please contact Dr Shaun Evans to discuss your gift:

Email: shaun.evans@bangor.ac.uk

Phone: +44 (0) 1248 383617

Post: ISWE Fund, The Development Office, Bangor University, Bangor, Gwynedd, LL57 2DG

Further Information

Bangor University is a Registered Charity: No. 1141565

When you make a Gift Aid donation, we can reclaim from HMRC the basic rate tax which you have already paid on your gift. This increases the value of your gift to us by 25%, at no extra cost to you. If you are a higher rate taxpayer, you can also claim the difference between higher rate and basic rate tax on the total value of your gift to the University on your Self Assessment tax return.

For further information on how to make your gift, and how best to structure your gift to take advantage of tax relief for donors, please contact our Development Office.